Supercharge your business with our State of the art Lending Management System

Superlender is a lending management system that is designed to make lending easier, faster, and more secure for lenders and borrowers alike. With features that are sophisticated and affordable, Superlender is the ideal solution for any lending institution.

Get Started

Features

Fast:

Our Lending Management System is designed with speed in mind. With its streamlined processes and efficient algorithms, it enables swift loan processing, reducing the waiting time for borrowers. By automating various tasks and workflows, the system ensures that loan applications are quickly evaluated, approved, and disbursed. This not only enhances customer satisfaction but also improves operational efficiency, enabling your lending institution to serve more clients in less time.Secure:

Security is of paramount importance when it comes to managing financial transactions and sensitive customer information. Our Lending Management System prioritizes security at every level. It incorporates robust encryption protocols, authentication mechanisms, and access controls to safeguard data integrity and protect against unauthorized access. With regular security updates and adherence to industry best practices, you can trust that your lending operations are shielded from potential threats, ensuring the confidentiality and trust of your customers.Sophisticated:

Our Lending Management System boasts a sophisticated set of features and functionalities that cater to the complex needs of modern lending institutions. From comprehensive loan origination and underwriting processes to advanced risk assessment models, the system empowers your organization to make informed decisions and optimize lending strategies. Its sophisticated algorithms leverage data analytics to identify trends, assess creditworthiness, and minimize risks, ultimately leading to improved loan portfolio management and profitability.

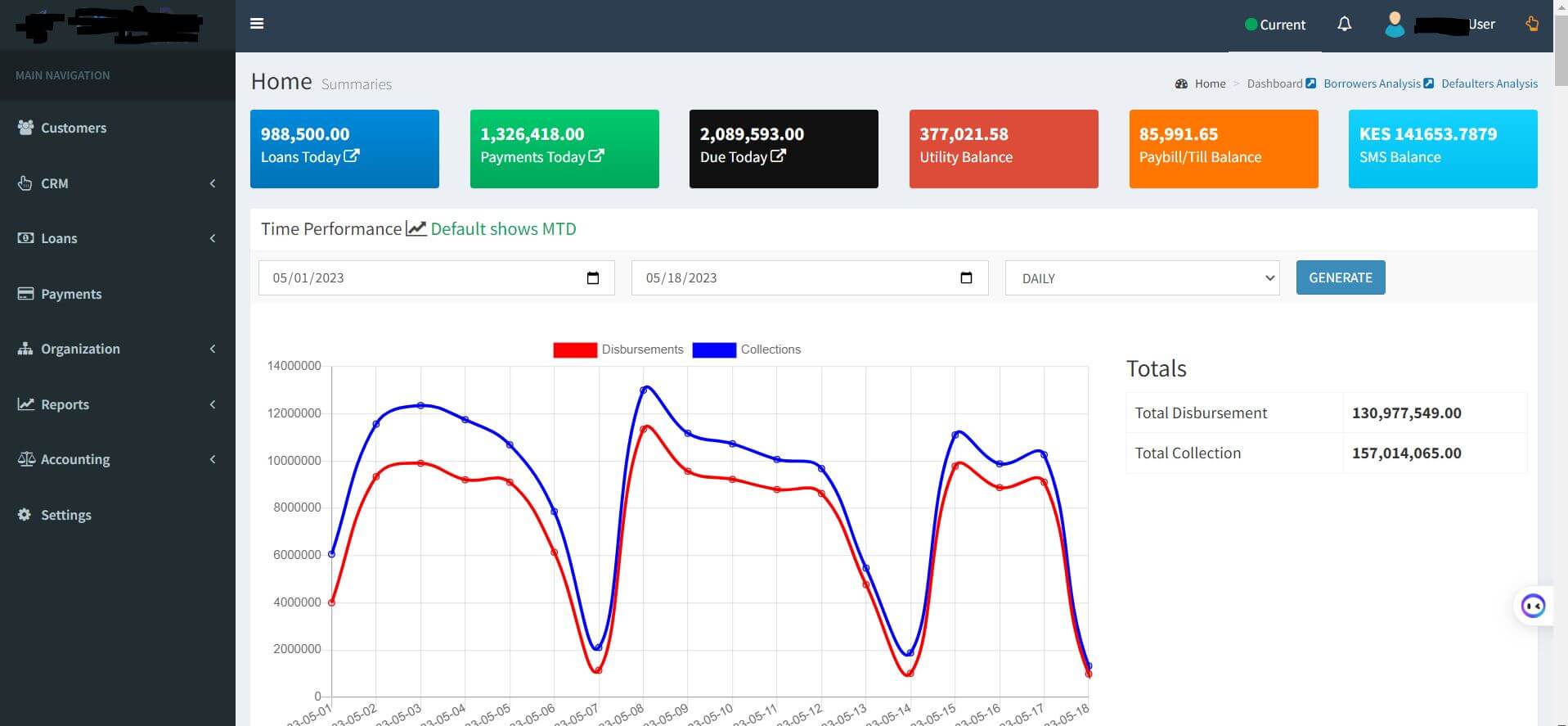

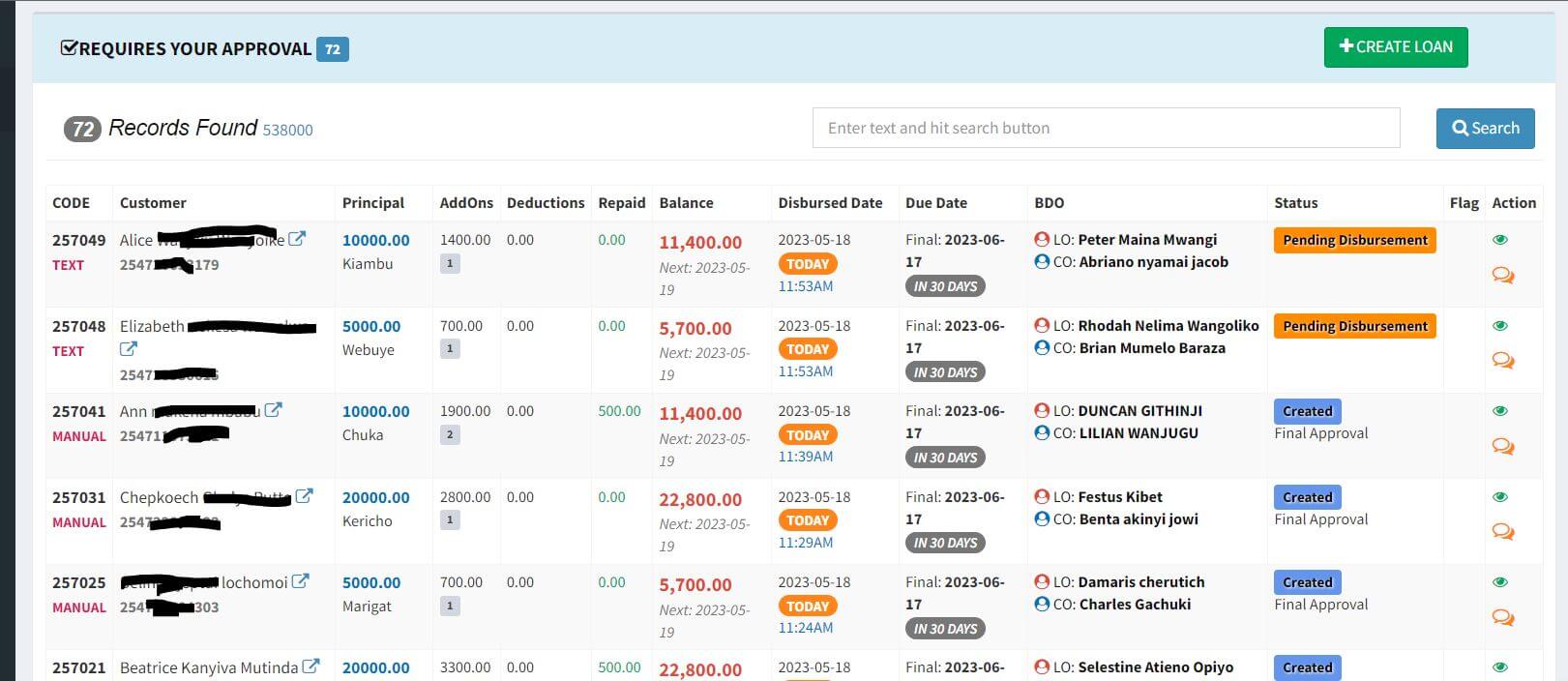

Intuitive Dashboards:

The Lending Management System offers intuitive and user-friendly dashboards that provide a clear overview of your lending operations. These dashboards present key performance indicators, loan statuses, and other relevant metrics in a visually appealing and easy-to-understand manner. With real-time updates and customizable display options, you can monitor and track loan disbursements, repayments, delinquency rates, and other vital information at a glance. The intuitive dashboards facilitate better decision-making, allowing you to stay proactive and responsive to changing market dynamics.Self-customizable Reports:

Our Lending Management System empowers you to generate self-customizable reports tailored to your specific needs. With a variety of report templates and flexible parameters, you can extract valuable insights from your lending data. Whether you require detailed loan portfolio reports, financial statements, or performance analytics, the system allows you to generate comprehensive and visually appealing reports effortlessly. By gaining deeper visibility into your lending activities, you can identify areas of improvement, track key metrics, and demonstrate compliance with regulatory requirements.Full Integration with SMS, Mobile Money, USSD, Mobile App, and CRB:

To ensure seamless connectivity and accessibility, our Lending Management System offers full integration with various communication channels and external systems. This includes integration with SMS services for automated loan notifications, mobile money platforms for convenient payment processing, USSD for easy customer interactions, mobile applications for on-the-go access, and Credit Reference Bureaus (CRBs) for reliable credit history checks. These integrations enhance the user experience, optimize operational efficiency, and enable you to leverage the latest technologies for a competitive edge.

Device Compatibility:

Our Lending Management System is designed to be fully responsive and compatible with all devices, including desktops, laptops, tablets, and smartphones. Whether you are accessing the system from the office or on the move, you can conveniently manage your lending operations from any device with an internet connection. The responsive design ensures that the system adapts to different screen sizes, providing a seamless user experience across platforms. This flexibility enables you and your team to work efficiently and access critical information anytime, anywhere.Pricing

Superlender offers flexible pricing options to suit the needs of any lending institution. Our pricing is designed to be affordable, so that you can focus on growing your business instead of worrying about costs.

| Plan | Price |

|---|---|

| SAS | From KES 20K/month |

| Buy Out | Contact us for pricing |

Superlender in Action

Testimonials

Superlender has transformed the way we do lending! Its speed and efficiency have elevated our customer experience to new heights. With robust security measures, we rest easy knowing our clients' data is protected. The system's sophisticated features and analytics empower us to make smart lending decisions, minimizing risks and maximizing profitability.

Superlender revolutionized our lending operations! With its lightning-fast loan processing, ironclad security features, and sophisticated risk assessment capabilities, it's a game-changer for our institution. The intuitive dashboards provide real-time insights, empowering us to make informed decisions on the fly. Highly recommend